Instant Mortgage Pre-Qualification

Led research and design for a mortgage tool that calculates a customer’s potential home loan, and streamlines our internal sales process.

Overview

The project

We designed a new tool for customers to get pre-qualified for a mortgage in just a few minutes, speeding up the sales process for our agents and the mortgage process for our customers.

My Role

Design lead

Duration

Six months

Release

Feb 2023

Team

Me, PM, 5 engineers

Background

The Orchard sales process

Orchard is a real estate startup that streamlines the home buying and selling process for customers. Orchard qualifies customers for an “equity advance,” essentially a bridge loan, that frees up equity in the customer’s old home, enabling them to buy their new home before listing the old one.

Determining the equity advance

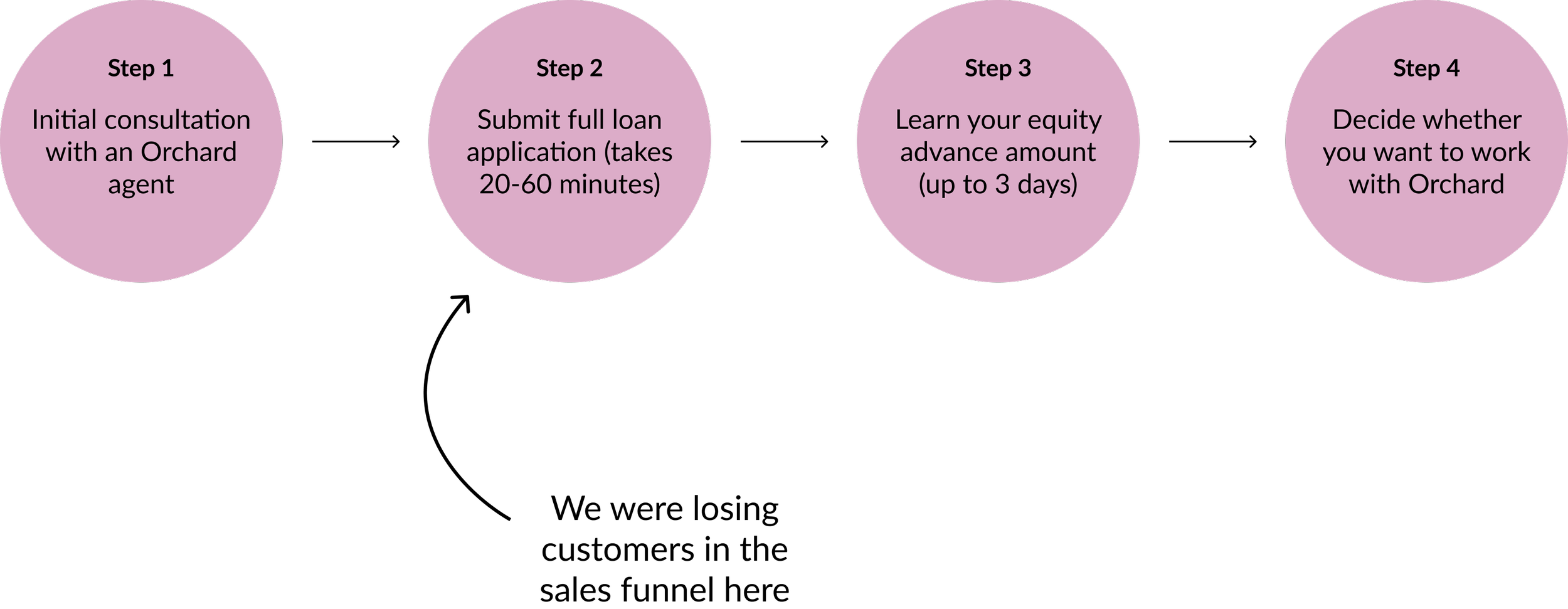

In order to receive their equity advance amount, a customer must submit a loan application to Orchard Mortgage. The application usually takes between 20 and 60 minutes and involves uploading documentation of income, assets, and a hard check of the customer’s credit score (this temporarily lowers a customers’ credit score).

While customers can technically sign documents agreeing to work with Orchard before submitting their loan application, many customers understandably want to learn their equity advance amount before committing to Orchard. Therefore, the typical customer flow was to submit the Orchard Mortgage loan application as a pre-requisite before “booking” with Orchard.

The problem

We heard feedback from both Orchard agents and customers that the process to approve the customer’s equity advance amount was creating unnecessary friction in the pre-booking sales process.

A 20-60 minute application and hard credit check was deterring customers from moving forward with their equity advance, and blocking them from moving forward with Orchard.

The opportunity

We believed pre-qualification, a faster way to deliver the equity advance amount, would provide value to both the customer and business. It could:

Provide value to the customer with much less effort than the previous loan application

Speed up the sales process by simplifying a cumbersome application for customers

What we knew from customer research

We spoke with several internal agents and several customers to gauge whether learning your “buying power” was a compelling value prop to customers and if it could be a useful tool for agents.

We also gathered feedback on their experience with Orchard Mortgage thus far.

This is a frequently asked question?

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

This is a frequently asked question?

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

This is a frequently asked question?

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

This is a frequently asked question?

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

Project scoping and requirements

We leveraged these insights into our requirements and goals for the project